The West African Examination Council (WAEC) , has set the 2025 WAEC Economics Questions And Answers paper for 4th June 2025. Candidates are now preparing to perform well in the upcoming examination through the help of reliable resources, such as:

- WAEC Economics 2025 Questions and Answers

- WAEC Economics Expo 2025

- WAEC Economics Question 2025

- WAEC Economics Answer 2025

If you are one of these candidates, this article has provided the step-by-step guide on how to prepare effectively for access to verified solutions and to succeed in your 2025 WAEC Economics exam.

How to Get 2025 WAEC Economics Questions and Answers

At MasterWAEC, we are committed to the success of candidates. Our platform provides accurate and verified solutions tailored to help you boost your confidence and increase your chances of making high grades like B2, B3, and C’s.

Available Subscription Options for WAEC Answers

We have made it easy for you to access WAEC Economics answers by providing two convenient subscription methods:

1. Online PIN (₦1000)

Get access PIN to view verified answers online on our answer page. Answers will be delivered 4 hours before the exam starts.

2. WhatsApp Delivery (₦1000)

Get the answers directly on WhatsApp after confirmation of your subscription. Get the answers delivered straight to your phone.

How to Subscribe for WAEC Answers

Here is the simple procedure one should follow in order to secure his/her access:

- Pay The Subscription Fee:

Use any preferred payment method. For account details, chat with us on WhatsApp at 08023429251.

- Provide the Required Details:

Send the following information to 08023429251 on WhatsApp:

- Evidence of payment (e.g., transfer receipt or sender’s name).

- The subject you’re subscribing for (e.g., WAEC Economics).

- Your phone number.

Once your payment is confirmed, the answers will be delivered based on your preferred method.

Why Choose masterWAEC?

Here are the reasons why thousands of candidates trust masterWAEC.com for their exam preparation:

1. Verified Answers: We deliver accurate solutions designed to guarantee success.

2. Timely Delivery: Answers will be delivered at least 4 hours before your exam time or by midnight.

3. Flexible Subscription Methods: Use whatever method that works for you, whether it is online PIN or WhatsApp delivery.

4. Dedicated Support: Our support team is always ready to attend to any issues or questions you might have.

Join the WAEC Miracle Center

Join our private WhatsApp group, where we will be providing:

- Verified answers

- Timely updates

- Pro tips to aid your success

Conclusion

The WAEC Economics 2025 exam is your opportunity to show the world what you are made of and to come out with fantastic grades. With masterWAEC.com trusted resources, you can prepare with confidence and secure the results you desire.

ALSO READ:

2025 WAEC Food And Nutrition Questions and Answers

2025 WAEC English Language Questions and Answers

2025 WAEC Civic Education Questions and Answers

2025 WAEC Government Questions And Answers

2025 WAEC Agricultural Science Questions And Answers

2025 WAEC Commerce Questions And Answers

Don’t wait, subscribe today, and let us guide you toward academic success!

For more information, reach out to us on 08023429251, and also join our WhatsApp platform for up-to-date information.

2025 WAEC Economics Exam Format

WAEC Economics 2025 paper is divided into two parts:

PAPER 1: This paper consist of 50 objectives questions which candidate will answers in 1 hour for 50 marks

PAPER 2: the paper 2 consist of 8 essay questions which is divided in to two sections.

Candidates are required to answers 4 questions in all, one question from section A and any other 3 from section B.

The economics essay paper will last for 2 hours and also carried 80 marks.

2025 WAEC GCE Economics Questions And Answers

Below are the questions and answers for the 2025 WAEC GCE Economics exam:

Question 1

Table 1 below shows the population and Net National Product (NNP) at factor cost for three hypothetical countries in 2021. Use the information in the table to answer the questions that follow.

| Country | Net National Product at Factor Cost ($) | Population |

|---|---|---|

| Q | 140 million | 12 million |

| S | 240 million | 10 million |

| U | 160 million | 10 million |

(a) Calculate the per capital income of country:

(i) Q

(ii) S

(iii) U

(b). From your answers in 1(a), which country has the lowest standard of living?

(c). If in 2022, both the Net National Product (NNP) at factor cost and population of country S declined by 7%:

(i). Calculate the new per capita income.

(ii). What will be the effect on the country’s standard of living?

(d) If the factor income received by the citizens of Country U from abroad is $10 million and the factor income paid to foreigners in the country is $33 million, calculate the Country’s Net Domestic Product (NDP) at factor cost.

Question 2

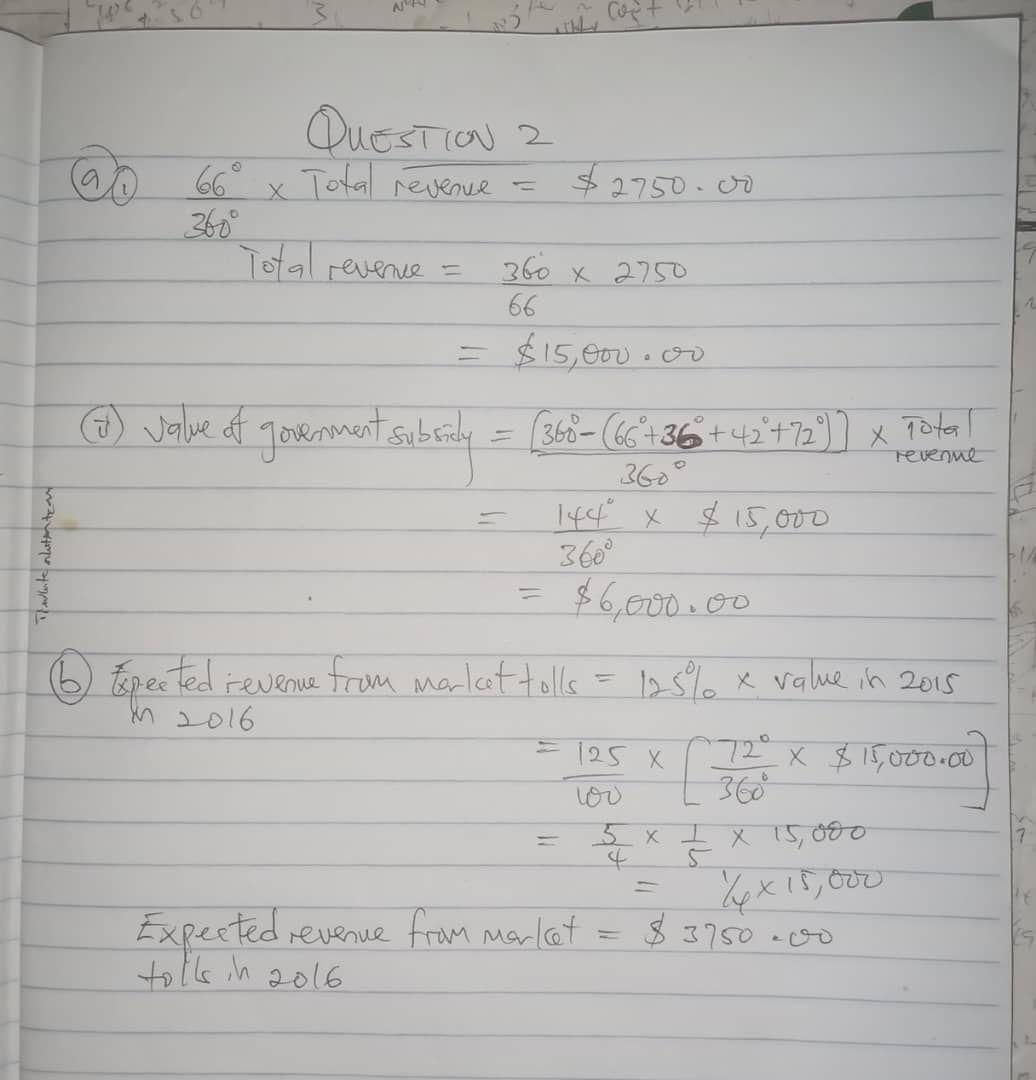

The pie chart in Figure 1 shows the sources of revenue for a local government area in 2015. Study the information and use it to answer the questions below.

(a) If the value of revenue contributed by NGOs was $2,750.00 in 2015:

(i) What was the total revenue for the local government area?

(ii) Calculate the value of Government subsidy.

(b) If the local government area in its 2016 budget projected an increase of 25% for market tolls, calculate the expected revenue from market tolls in 2016.

(c) In 2016, the local government area received $8,500.00 from the Federal Government and it was spent as follows:

- Construction of Schools: 40%

- Wages and Salaries: 30%

- Civic Education: 5%

- Assistance to the Physically Challenged: 10%

- Provision of Pipe-Borne Water: 15%

Question 6: (a) Define the supply of money

supply of money refers to the total amount of money available in an economy at a given time. It includes currency (coins and banknotes) and various types of deposits (such as demand deposits, savings deposits, and time deposits) held by the public in the banking system.

Question 6: (b) Explain how the general price level is influenced by the:

(i). Quantity of money in circulation: The quantity of money in circulation has a direct influence on the general price level. When the money supply increases, there is more money available for spending, leading to increased demand for goods and services. This increased demand, without a corresponding increase in the supply of goods and services, causes prices to rise, resulting in higher inflation

(ii). Velocity of circulation of money: The velocity of money refers to the rate at which money circulates in an economy. If the velocity of money increases, it means that each unit of money is used more frequently to purchase goods and services. This increased velocity of money can lead to higher inflation, as the same amount of money is being used to buy more goods and services.

(iii). Volume of goods and services: The volume of goods and services available in the economy also affects the general price level. If the volume of goods and services increases, while the money supply remains constant, the increased supply of goods and services will put downward pressure on prices, leading to lower inflation or even deflation.

Question 6: (c) Outline any three determinants of the precautionary demand for money

PICK ANY THREE:

- Income level: Individuals with higher incomes tend to hold more precautionary money balances to protect against unexpected expenses or income fluctuations.

- Uncertainty about future income: Individuals who face greater uncertainty about their future income are more likely to hold larger precautionary money balances.

- Risk aversion: Individuals with a higher degree of risk aversion are more likely to hold larger precautionary money balances to protect against unexpected events.

- Access to credit: Individuals with limited access to credit or borrowing options may hold larger precautionary money balances to cover unexpected expenses.

- Financial volatility: Periods of higher financial volatility or economic uncertainty can increase the precautionary demand for money.

- Liquidity preferences: Individuals who prefer to maintain a higher degree of liquidity will hold larger precautionary money balances.

- Life-cycle stage: Individuals in different stages of their life cycle (e.g., retirement) may have different precautionary money balance needs.

- Household composition: The size and composition of a household can affect the precautionary demand for money, as larger households may face more unexpected expenses.

Question 7: (a) Define commercial policy.

Commercial policy refers to the set of government policies and measures that aim to regulate and control the flow of goods, services, and capital between a country and the rest of the world. It includes policies related to trade, investment, and other commercial activities.

Question 7: (b) Identify any three fiscal instruments that can be used to correct a balance of payments deficit.

PICK ANY THREE

- Tariffs: Imposing tariffs or duties on imported goods can make them more expensive, thereby reducing imports and improving the trade balance.

- Quotas: Imposing quantitative restrictions on the amount of certain imported goods can limit the inflow of imports and improve the balance of payments.

- Subsidies: Providing subsidies to domestic producers can make their goods more competitive in the domestic and international markets, boosting exports and reducing imports.

- Exchange rate adjustments: Devaluing the domestic currency can make exports more competitive and imports more expensive, improving the trade balance.

- Import restrictions: Implementing non-tariff barriers, such as licensing requirements or technical standards, can limit the inflow of imports.

- Export promotion: Providing incentives, such as tax credits or subsidies, to domestic exporters can increase the volume of exports and improve the balance of payments.

Question 7: (c) Explain three reasons free trade should be encouraged.

- Increased efficiency and specialization: Free trade allows countries to specialize in the production of goods and services in which they have a comparative advantage, leading to increased efficiency and productivity.

- Wider consumer choice: Free trade expands the variety of goods and services available to consumers, allowing them to choose from a wider range of products.

- Lower prices: Competition from imports can put downward pressure on domestic prices, benefiting consumers.

Question 8: (a) Define renewable natural resources.

Renewable natural resources are resources that can be replenished or regenerated naturally over time and are considered inexhaustible if managed sustainably.

Question 8: (b) With specific examples, explain any three benefits of renewable natural resources to an economy.

- Sustainable Energy Supply: Renewable resources like solar, wind, and hydro energy provide a continuous and sustainable source of power. This helps reduce dependency on non-renewable sources like fossil fuels, ensuring long-term energy security for the economy.

- Job Creation: The development, maintenance, and management of renewable energy resources create employment opportunities in sectors like solar panel installation, wind turbine manufacturing, and sustainable agriculture. This helps reduce unemployment and stimulates local economies.

- Environmental Protection: Renewable resources like wind, solar, and biomass energy produce less pollution compared to fossil fuels. Their use helps reduce air and water pollution, mitigating the effects of climate change and improving public health, which in turn supports a stable economy.

Question 8: (c) Highlight any three importance of land to an economy.

- Source of Raw Materials: Land provides essential raw materials like minerals, timber, agricultural products, and other natural resources that are crucial for industries, manufacturing, and construction. These materials are the foundation for economic activities and production.

- Agricultural Production: Land is the basis for farming and agriculture, which supply food, fiber, and other essential products. Agricultural activities contribute significantly to an economy’s GDP, employment, and food security, making land vital for sustaining populations.

- Employment Generation: The use of land for farming, mining, construction, and industrial activities creates numerous job opportunities for individuals in both rural and urban areas. This helps reduce unemployment and drives economic growth.

RELATED POST:

2025 WAEC GCE Civic Education Questions and Answers

2025 WAEC Commerce Questions And Answers (WASSCE)

WAEC GCE Timetable 2025 for First Series PDF

2025 WAEC GCE English Language Questions and Answers

2025 WAEC GCE Agricultural Science Questions And Answers

Best Site for WAEC GCE Expo 2025 – Private WASSCE

Conclusion

This post has provided you with sample questions to guide you on your exam preparation. By using this information and staying committed to your preparation, you can approach the exam with confidence and achieve excellent results.

Dont forget to revisit this page for guidance as the exam approaches. Best of luck in your 2025 WAEC GCE Economics examination!

Kolade Kayode, known as Mr. KK, I am a Nigerian education blogger and founder of MasterWAEC.com. Passionate about student success, I simplifies WAEC exam preparation with accurate tips and resources to help students excel.

7 thoughts on “2025 WAEC Economics Questions And Answers”